Introduction

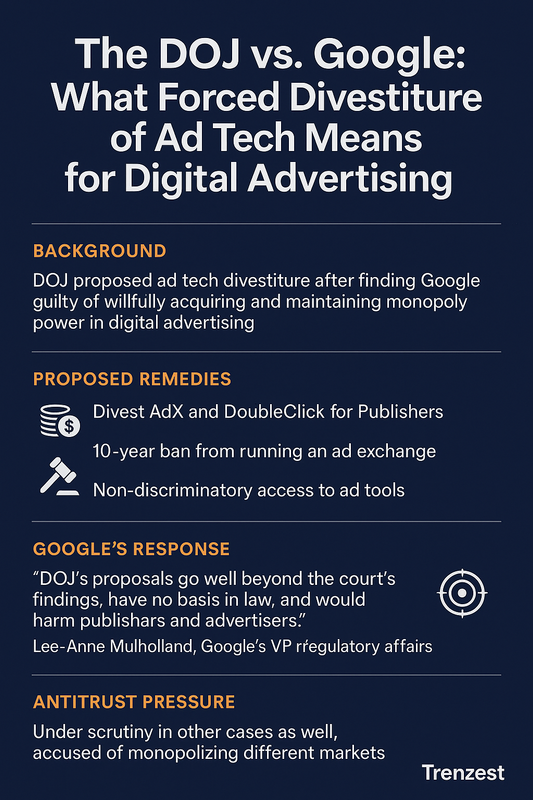

In a landmark move set to reshape the digital advertising ecosystem, the U.S. Department of Justice (DOJ) has proposed that Google divest major portions of its advertising business. The recommendation follows a judicial finding that Google “willfully acquired and maintained monopoly power” in the online advertising space. If approved, these measures could drastically alter how advertisers, publishers, and platforms interact in the ad tech ecosystem.

Background: DOJ’s Legal Action Against Google

The legal battle began years ago, but it reached a tipping point when a federal judge ruled that Google had unfairly leveraged its dominance to stifle competition. The DOJ’s central claim? That Google manipulated the digital ad ecosystem to maintain its monopoly, particularly by tying its publisher-side ad server (DoubleClick for Publishers) with its ad exchange (AdX), effectively locking in market participants and eliminating competition.

This case is part of a broader antitrust crackdown by U.S. regulators who are increasingly scrutinizing Big Tech’s growing influence across sectors—from search and browsers to app stores and advertising.

The Proposed Remedies and Their Implications

Divestiture of AdX and DoubleClick for Publishers

The DOJ wants Google to divest two critical components of its ad tech stack:

AdX (Ad Exchange): A platform connecting advertisers with publishers in real-time.

DoubleClick for Publishers (DFP): A tool for managing and delivering ads on publisher websites.

Together, these products allowed Google to consolidate control over both the supply and demand sides of digital advertising. The DOJ argues that this integration forced publishers to adopt Google’s tools or risk losing significant revenue.

10-Year Ban from Running an Ad Exchange

Beyond divestiture, the DOJ proposes barring Google from operating any ad exchange for a decade. This aggressive measure aims to prevent the company from re-entering the market with undue influence and is designed to create room for other players to emerge and innovate.

Non-Discriminatory Access to Google’s Ad Tools

To promote fair competition, the DOJ also demands that Google:

Open its ad buying tools (like AdWords) to work with all third-party ad tech services.

Operate these tools on non-discriminatory terms, ensuring no preferential treatment based on affiliation with Google.

This could lead to a more interoperable ecosystem, making it easier for smaller platforms and agencies to compete on a level playing field.

Google’s Response and Counterproposal

Unsurprisingly, Google has pushed back. In a public statement, Lee-Anne Mulholland, Google’s VP of regulatory affairs, argued that the DOJ’s proposed remedies go far beyond what the court found to be necessary.

“The DOJ’s additional proposals to force a divestiture of our ad tech tools go well beyond the Court’s findings, have no basis in law, and would harm publishers and advertisers,” said Mulholland.

Google’s alternative proposal includes:

Allowing AdX real-time bidding access to all third-party ad servers, not just Google’s.

Submitting its operations to an independent compliance monitor for three years to ensure transparency and accountability.

The Bigger Picture: Antitrust Pressure from All Sides

This is not an isolated case. Google is also facing legal pressure to divest its Chrome browser due to its dominance in online search—an area where it was also deemed a monopoly. As governments globally crack down on digital monopolies (e.g., the EU’s Digital Markets Act), the tech industry may be entering a new era of enforced decentralization and transparency.

Why This Matters for Entrepreneurs, Publishers, and Advertisers

If you’re a marketer, small business owner, or tech entrepreneur, these developments are highly relevant:

More Choices for Publishers: A diversified ad tech market could reduce dependence on Google’s tools.

Fairer Ad Pricing: Increased competition could lead to lower ad costs and higher margins for advertisers.

Transparency & Control: Businesses may regain more control over data and ad placements.

For those building ad-reliant platforms or digital media ventures, understanding this shift is essential for future-proofing your strategies.

Trenzest’s Perspective: Navigating the Future of Ad Tech

At Trenzest, we believe that democratizing ad tech is a step in the right direction. Whether you’re launching a media site, running an eCommerce business, or scaling a SaaS product, the changes underway present opportunities to rethink your advertising strategy.

Conclusion: What Happens Next?

The final outcome of the DOJ’s proposal remains uncertain. The legal process may take months—or even years—to play out. However, the signal is clear: the age of unchecked dominance in digital advertising is under scrutiny. Whether Google retains its assets or not, the industry is heading toward a more regulated and competitive future.

As a business leader or marketer, now is the time to diversify your ad tech stack, monitor these developments closely, and invest in platforms that offer flexibility, transparency, and scale.