Table of Contents

- Introduction

- Djamo’s Unique Market Positioning

- A Record-Breaking Funding Round

- Bridging the Financial Access Gap

- The Evolution of Mobile Money and Its Limitations

- Djamo’s Approach: A Hybrid Financial Model

- Expanding Financial Services

- Catering to Small Businesses

- Revenue Growth and Future Prospects

- Competition and Expansion into Senegal

- Investment and Scaling Ambitions

- Conclusion

Introduction

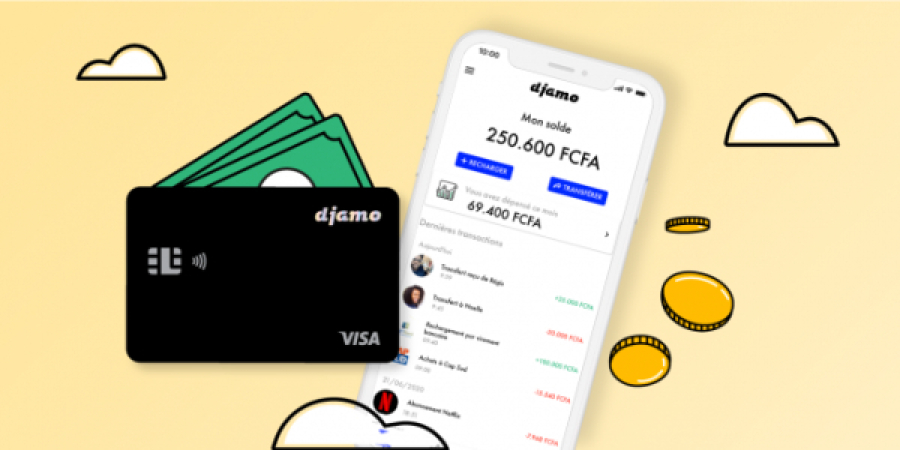

Djamo, a digital banking startup, is revolutionizing financial services in Francophone West Africa. Unlike competitors focusing on larger economies such as Nigeria, Egypt, or South Africa, Djamo has carved out a unique space in Ivory Coast and Senegal. With over one million customers, the fintech startup is making financial services more accessible to the region’s underbanked population.

Djamo’s Unique Market Positioning

While most fintech startups target large African economies, Djamo has chosen to focus on the French-speaking West African market. This strategic decision allows it to address financial inclusion challenges that are often overlooked in the region. Djamo’s core mission is to provide accessible and affordable banking solutions tailored to the needs of its customers.

A Record-Breaking Funding Round

Recently, Djamo secured $17 million in equity funding, marking the largest VC round for an Ivorian startup. This surpasses its $14 million Series A round in 2022, demonstrating strong investor confidence in its mission. The company’s valuation has doubled since its last fundraising effort, highlighting its rapid growth and market potential.

Bridging the Financial Access Gap

Founded in 2020 by Hassan Bourgi and Régis Bamba, Djamo aims to bridge the financial access gap in Francophone Africa, where traditional banking services are primarily designed for the affluent. Many residents rely on mobile money for financial transactions, yet this system lacks the sophistication of full banking services, such as savings, credit, and investment options.

The Evolution of Mobile Money and Its Limitations

Mobile money has transformed financial inclusion in Africa, with 28% of Sub-Saharan adults owning mobile money accounts, according to the World Bank. However, while mobile money is convenient, it primarily supports basic financial transactions—cash-in, cash-out, peer-to-peer (P2P) transfers, and bill payments—without offering wealth-building tools such as credit or investment options.

Djamo’s Approach: A Hybrid Financial Model

Djamo bridges the gap between mobile money and traditional banking. Its model combines the accessibility of mobile money with the financial depth of bank accounts. Similar to Nigeria’s OPay and PalmPay, Djamo targets young, upwardly mobile users who seek more advanced financial tools without the high costs and inefficiencies of conventional banks.

Expanding Financial Services

Over the past year, Djamo has expanded its services beyond cards and P2P transfers. It now offers:

- Savings vaults for secure financial planning.

- Investment products, facilitated by the region’s first fintech-issued brokerage license.

- Salary-linked bank accounts, which improve financial inclusion for employees.

Currently, only 5–10% of Djamo’s users receive salaries through the app. The company’s next phase involves increasing this percentage to 50%, making Djamo the primary banking choice for more customers.

Catering to Small Businesses

Djamo is also focusing on the small business segment, having onboarded approximately 10,000 businesses. The fintech provides a suite of business-friendly services, including:

- Bulk payment solutions.

- Payment links for seamless transactions.

- QR code-based payment tools.

This business banking expansion enhances financial accessibility for entrepreneurs, fostering economic growth in the region.

Revenue Growth and Future Prospects

Djamo generates revenue through:

- Merchant fees on online card transactions.

- A premium subscription plan, adopted by 25% of its users.

The company is exploring additional revenue streams, including lending and interest-bearing savings accounts, pending regulatory approval.

Since 2022, Djamo has grown its revenue fivefold and processed over $4.5 billion in transactions, underscoring its significant market traction.

Competition and Expansion into Senegal

With its recent expansion into Senegal, Djamo faces competition from Wave, a leading mobile money provider. However, rather than directly competing, Djamo positions itself as a complementary service, providing advanced financial tools that traditional mobile money lacks. By offering services like investments and credit, Djamo differentiates itself in a crowded fintech landscape.

Investment and Scaling Ambitions

The $17 million funding round was led by Janngo Capital, a pan-African, gender-focused VC firm. According to Janngo’s founder, Fatoumata Bâ, Djamo’s mission aligns with the urgent need for financial inclusion in Francophone Africa, where less than 25% of adults have access to formal banking services. Notably, a third of Djamo’s users are women, helping to bridge the gender financial gap.

Other investors in the round include:

- SANAD Fund for MSMEs (managed by Finance in Motion).

- Partech.

- Oikocredit.

- Enza Capital.

- Y Combinator.

Conclusion

Djamo’s rapid growth, innovative financial solutions, and strategic expansion make it a key player in Francophone Africa’s fintech ecosystem. With continued investor confidence and a strong commitment to financial inclusion, Djamo is well-positioned to redefine banking in the region.

For entrepreneurs, marketers, and fintech enthusiasts interested in financial inclusion, Trenzest.com provides in-depth insights into the latest fintech trends and innovations.