Quantum computing has long been touted as the next technological revolution, promising to solve problems that are far beyond the reach of classical computers. While the industry has often faced delays and lofty claims, several companies—both giants and startups—are now turning that vision into a commercial reality.

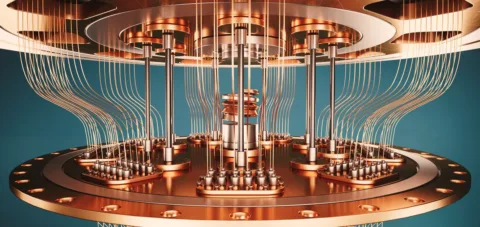

These companies are working to tackle an array of challenges, from advancing medicine and cybersecurity to innovating in materials science and chemistry. However, one of the most immediate technical hurdles is developing quantum chips that can support large numbers of reliable qubits—the basic unit of quantum information.

While tech giants like Google, Microsoft, and Amazon are leading the charge, a growing wave of startups is tackling critical bottlenecks such as error correction and system scalability. These emerging players, often working from first principles or with novel architectures, may prove just as influential.

Let’s take a closer look at some of the key players in the quantum chip race and what they’re building:

Noteworthy Startups Making Bold Moves

Akhetonics (Germany)

Focus: All-optical, general-purpose quantum chips.

Funding: Raised €6 million seed round in Nov 2024.

Approach: Contrarian, photonics-based chip design.

Alice & Bob (France)

Focus: Full-stack fault-tolerant quantum systems using cat qubits.

Funding: Raised $104 million Series B in Jan 2025.

Atom Computing (USA)

Focus: Neutral atoms arranged with optical traps.

Collaboration: Partnered with Microsoft to launch a commercial quantum computer in 2025.

EeroQ (USA)

Focus: Helium-based chip design.

Funding: Raised $7.25 million; expanding HQ in Chicago with $1.1 million investment.

IQM (Finland)

Focus: Superconducting quantum computers.

Background: Spinout from Aalto University and VTT.

Funding: €128 million Series A2 in 2022; €39 million in 2020.

Pasqal (France)

Focus: Neutral atoms; full-stack systems.

Funding: €100 million Series B in 2023.

Co-Founder: Alain Aspect, Nobel Laureate.

Quandela (France)

Focus: Photonic quantum computers.

Funding: €50 million Series B in 2023, supported by France 2030 Plan.

QuEra (USA)

Focus: Neutral atom systems; 256-qubit Aquila computer.

Funding: $230 million debt round in Feb 2025 led by Google.

QuantWare (Netherlands)

Focus: Scalable 3D QPU architectures.

Product: Contralto-A for quantum error correction.

Funding: €20 million Series A in March 2025.

Qilimanjaro (Spain)

Focus: Analog quantum ASICs and full-stack development.

Funding: €1.5 million from Catalonia in 2024.

SEEQC (USA)

Focus: Energy-efficient, scalable quantum chips.

Partners: Nvidia (chip-to-GPU link), BASF, Merck.

Funding: $30 million round in Jan 2025.

Xanadu (Canada)

Focus: Photonics-based quantum systems.

Latest: Aurora (12-qubit system with 35 photonic chips).

Funding: $275 million to date.

SpinQ (China)

Focus: Portable quantum computers using NMR (nuclear magnetic resonance).

Founded: 2018.

Big Tech’s Quantum Powerhouses

Latest Chip: Willow (Dec 2024).

Notable Claim: Demonstrated a major leap in quantum error correction.

Statement: Hartmut Neven suggested quantum computing may operate in “many parallel universes.”

Microsoft

Latest: Majorana chip (Feb 2025), based on topological quantum computing.

Goal: Build a quantum supercomputer within the next decade.

Amazon

First Quantum Chip: Ocelot (2025), in collaboration with Caltech.

Ecosystem: AWS Braket platform already supports systems from D-Wave, IonQ, and others.

IBM

Flagships: Condor (1,121-qubit) and Heron (156-qubit) superconducting chips.

Focus: Scaling and error reduction.

Intel

Approach: Silicon spin qubits.

Chip: Tunnel Falls (12-qubit), released in 2023; next-gen delayed beyond 2024.

Veterans & Public Players

D-Wave (Canada)

Tech: Quantum annealing.

Product: Advantage2 prototype.

Status: Public company, listed on NYSE.

IonQ (USA)

Tech: Trapped-ion systems.

Product: IonQ Forte.

M&A: Acquired Entangled Networks after going public via SPAC.

Rigetti Computing (USA)

Tech: Superconducting chips (Ankaa-3, upcoming Lyra with 336 qubits).

Strategic Partner: Quanta Computer (Taiwan); joint $100+ million investment.

PsiQuantum (USA/Australia)

Focus: Photonic architecture aiming for 1 million qubits.

Chipset: Omega, built at GlobalFoundries.

Funding: $450 million Series D (2021); potential $750 million round in 2025.

Quantinuum (USA/UK)

Formed by: Merger of Honeywell Quantum and Cambridge Quantum.

Product: H-Series (trapped-ion chips).

Partnership: Worked with Microsoft on error correction breakthrough in 2024.

Fujitsu & RIKEN (Japan)

Achievement: 256-qubit superconducting system announced in April 2025.

Progress: Quadrupled from a 64-qubit system in 2023.

Final Thoughts

The global quantum chip race is heating up, with a mix of deep-pocketed corporations and nimble startups bringing diverse technologies to the table—neutral atoms, superconductors, photons, and even helium. Each player contributes unique innovations aimed at cracking the toughest problems in quantum scalability, reliability, and performance.

While no one has won the race yet, the next few years promise to be pivotal. Whether it’s through a giant’s moonshot or a startup’s ingenious workaround, the path to practical quantum computing is being paved—qubit by qubit.